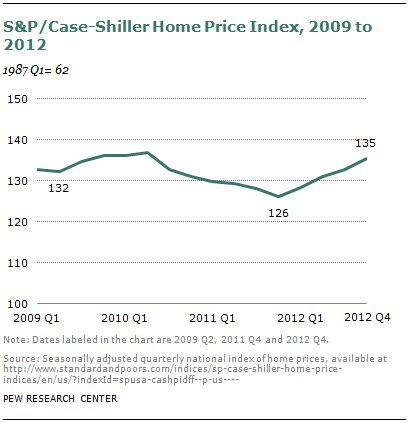

Asset Allocation Weekly - Is Monetary Policy Affected by Financial Markets? (November 5, 2021) - Confluence Investment Management

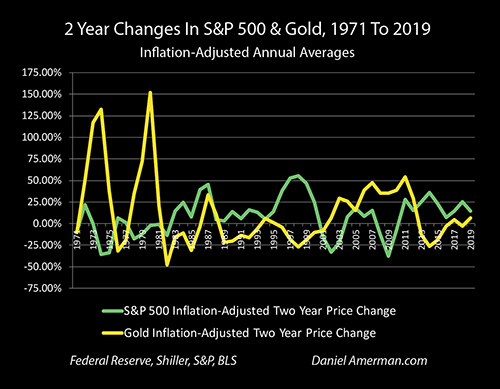

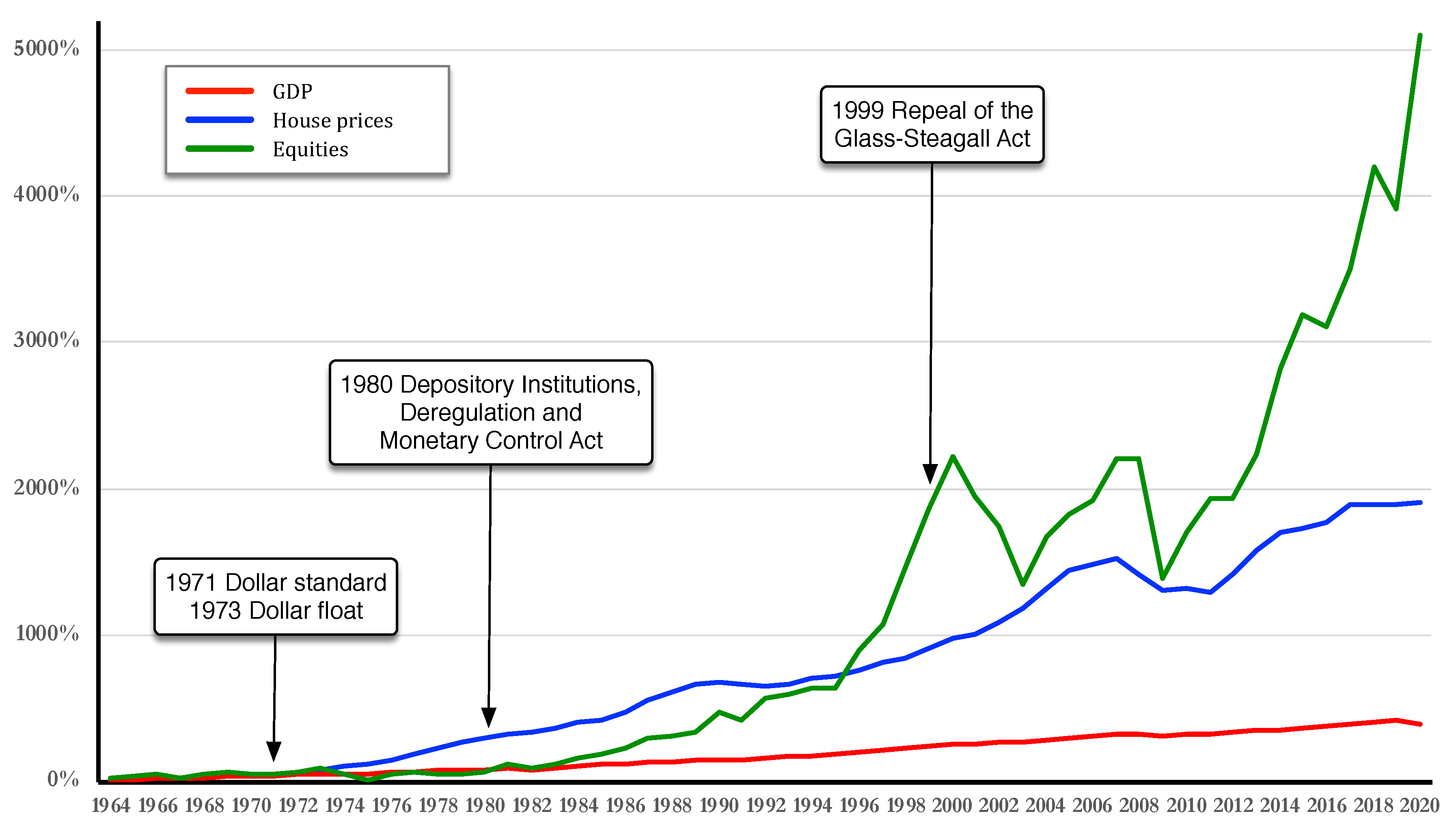

Using A Contracyclical Rebalancing Hedge For Stocks & Gold To Increase Inflation-Adjusted Returns From Price Changes By 50% While Lowering Risks by Daniel Amerman

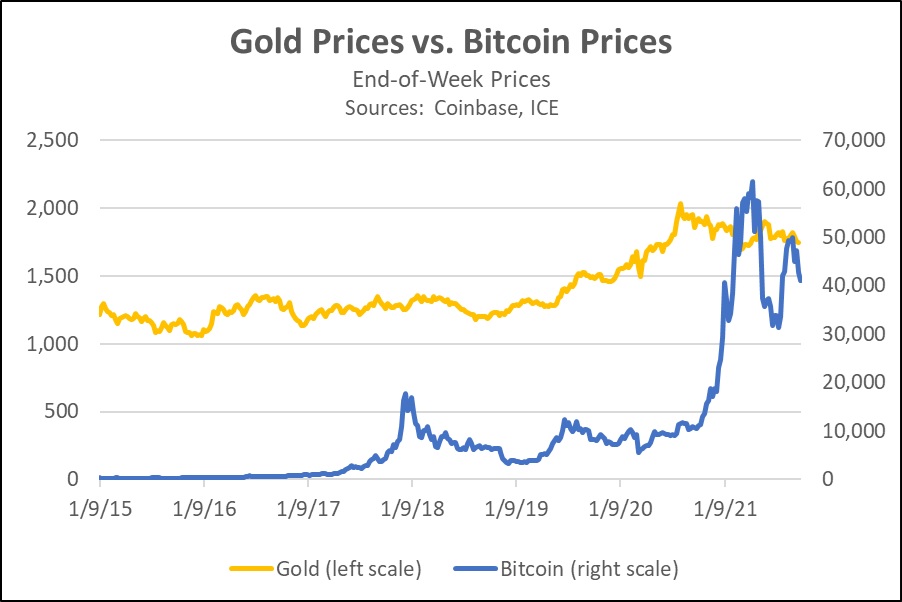

Asset Allocation Weekly - Has Bitcoin Become a Substitute for Gold? (October 8, 2021) - Confluence Investment Management

/dotdash_Final_Inverse_Correlation_Dec_2020-01-c2d7558887344f5596e19a81f5323eae.jpg)

:max_bytes(150000):strip_icc()/ForcesThatMoveStockPrices2-d78bc38c16c743ffa0a8cf63184934a7.png)

/dotdash_Final_Inverse_Correlation_Dec_2020-01-c2d7558887344f5596e19a81f5323eae.jpg)

:max_bytes(150000):strip_icc()/dotdash_Final_What_Impact_Does_Inflation_Have_on_the_Dollar_Value_Today_Nov_2020-01-f48d1dcef8354b77995bb5e2449153b8.jpg)